Contents:

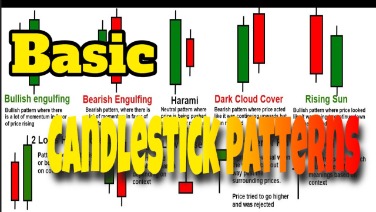

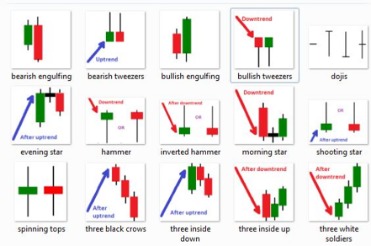

Now, for this buy setup, a bullish engulfing pattern appeared on the main pivot line, and when the third candle was completed, the candlestick indicator also alerted a Three Outside Up pattern. Supporting this is a recent bullish signal coming from the Ergodic Indicator. In this case, the entry if using the bullish engulfing formation would be at the third candle and the fourth if the Three Outside Up pattern. Having some definable rules of entry based on candlestick patterns can really help the aspiring trader.

Candlesticks are based on current and past price movements and are not future indicators. A break of a Master Candle on any time frame can be very profitable, but trading a break of a weekly Master Candle can be especially profitable. The January candle is bearish and when the price reaches the Fibonacci targets , it will have retraced back to the 38.2 and 50% Fib levels of the monthly candle. Even though in 2005, Toby Crabel was described by Financial Time as “the most well-known trader on the counter-trend side,” he still remains an unknown name in the retail industry. With the trade example above, volume remained relatively low during the formation of the range but clearly picked up slightly before and during the breakout .

To use this method, you must be extremely focused and execute orders flawlessly. Profit target amounts per trade can be set as one method of securing profit. Profit targets should be relative to the price of the security and range between 0.1 – 0.25 percent. In scalping, the assumption is that most assets will perform the first phase of their movement. Some stocks stop rising after that previous step, while others proceed to rise.

- https://g-markets.net/wp-content/uploads/2021/09/image-KGbpfjN6MCw5vdqR.jpeg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

- https://g-markets.net/wp-content/uploads/2021/09/image-Le61UcsVFpXaSECm.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth-164×164.jpg

When we have high volatility, the respect for support and resistance zones reduces. Zones are those spots on the chart where the price has reversed more than one time. The general rule on the strength of a zone; the larger number of people who see a zone, more important it becomes. A big red candlestick after a small green candlestick shows that the bears took control. Candlestick charts are great for improving your market timing and improve your risk reward ratio.

How to Read a Candlestick Pattern

If the occurrence is confirmed, then its third line may act as a resistance area . It also happens, however, that the pattern is merely a short pause prior further price increases. 📚 A bearish harami is a candlestick chart indicator for reversal in a bull price movement. Decline or near new lows is unlikely to be a valid bearish reversal pattern.

With neither buyers or sellers able to gain the upper hand, a spinning top shows indecision. Traditionally, candlesticks are best used on a daily basis, the idea being that each candle captures a full day’s worth of news, data, and price action. This suggests that candles are more useful to longer-term or swing traders. In the same manner, Stochastic reading below 20 means the market is oversold. Oversold is a market condition when there are too many buyers in the market and very few sellers. When there are few sellers, it means the price is going to shoot up pretty soon.

Shooting star

Additionally, it ensures that traders get the best price possible when entering and exiting the trade. For trading frequency compatibility, scalpers need adequate liquidity. These traders need access to accurate data as well as the ability to execute trades rapidly.

Usually, traders only go long when the current price is above the EMA, and short when prices go below the EMA. The opposite is true for the bullish pattern, called the ‘rising three methods’ candlestick pattern. It comprises of three short reds sandwiched within the range of two long greens. The pattern shows traders that, despite some selling pressure, buyers are retaining control of the market. Because the FX market operates on a 24-hour basis, the daily close from one day is usually the open of the next day. As a result, there are fewer gaps in the price patterns in FX charts.

Haramican be either bullish or bearish, and it is described as a candle that opens and closes within the previous candle’s real body. A bullish Harami pattern is when the candle on the left is a bearish or a red candle, and the one on the right is green or bullish. Conversely, a bearish Harami pattern is when the one on the left is green, and the right one is red. Harami mainly signals either a reversal or an extension, and it just depends on where it is situated. The main benefit of using the scalping trading style is related to the limitation of the market risk that could be involved in trading approaches using longer-term strategies.

Short Trade Example – The Pivot Scalping with Candlestick Patterns Strategy For MT4

Other candlestick patterns need two candles to be complete, or even up to 3 candles to form a combination formation. As explained in the previous paragraphs, each candle provides a valued source of information whether the market remains/changes to bullish, bearish or indecisive. Some of the candlesticks, however, do provide more value than others. These candlesticks have various names because they are of more importance than regular and “normal” candles. Even though the ORB NR4 pattern tends to lead to trend trading days, we’re more conservative and want to quickly take profits.

How to Generate Buy and sell Signals of stock trading? – FX Leaders … – FX Leaders

How to Generate Buy and sell Signals of stock trading? – FX Leaders ….

Posted: Mon, 06 Feb 2023 09:10:43 GMT [source]

Johan Nordstrom is a full-time trader, and a family guy in his early 30’s who trades the markets in a simple yet effective way. He has a master’s degree in risk management and years of experience trading the markets. He has helped hundreds of struggling traders become consistently profitable. Trend analysis is mainly an analysis of support and resistance levels created by horizontal price levels and trend lines.

The day of the gap the demand is so large that price opens above yesterday’s highest price. Because of this, we will probably see demand again if we come back to this price level. In an up or downtrend, the doji can be an indication that the trend is about to end if traded as a reversal or an indication that the trend is only taking a pause . Now, let’s outline where to place our protective stop loss and where to exit our profitable trade. Of course, you can only do that if your stop loss hasn’t been triggered in the meantime.

https://g-markets.net/ traders use patterns to help them determine when and where they should enter their positions, and the likely direction that price might move toward according to where a pattern forms. 📚 A bearish engulfing pattern can occur anywhere, but it is more significant if it occurs after a price advance. This could be an uptrend or a pullback to the upside with a larger downtrend.

What Type of Trader Are You? Let’s Find Out! – Altcoin Buzz

What Type of Trader Are You? Let’s Find Out!.

Posted: Wed, 11 Jan 2023 08:00:00 GMT [source]

There are a number of ways to calculate the moving average, but the two most common ones are simple and exponential moving average. The more volatile a market is, bigger the distance between the upper and lower levels of these zones. Occasionally, we have low volatility and then the zones are smaller and more precise. Gaps (price opens above or below yesterday’s highest or lowest price) are one other type of horizontal price level that is very powerful.

Momentum Indicators

IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Any research provided should be considered as promotional and was prepared in accordance with CFTC 1.71 and designed to promote the independence of investment research. It indicates the reversal of an uptrend, and is particularly strong when the third candlestick erases the gains of the first candle. It consists of consecutive long green candles with small wicks, which open and close progressively higher than the previous day. One indicator might give you a buy signal, but another indicator gives you a sell signal. Only add one or two indicators if you really feel they make a difference and make you a better trader.

Pattern near a significant support or resistance level increases the probability of a successful trade. The pattern is composed of a bearish candle that opens above but then closes below the midpoint of the prior bullish candle. 📌 Traders can use technical indicators, such as the relative strength index and the stochastic oscillator with a bearish harami to increase the chance of a successful trade. The formation is bearish because the price tried to rise significantly during the day, but then the sellers took over and pushed the price back down toward the open.

The hammer scalping candlestick patterns pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. Focus on one or two easy-to-read indicators, or a proven signal indicator like our10X Trading System combined with your technical analysis techniques for consistent results. The indicator determines the trend direction from the number of periods it is calculated on. If the price is above the moving average, the trend direction can be defined as up.

We’re going to share with you a powerful candlestick pattern strategy. When you first start out on your trading journey, you will be bombarded left and right with new concepts. This trading tutorial will show you how to read candlestick charts for beginners. 📚 An advance block is a three-period candlestick pattern considered to forecast a reversal. Scalping strategies may sound easy on paper, but they will devour traders with a lack of experience.

The next feature of scalping is the ability to gain profit from slow or ranging markets. When the asset is moving sideways during days or even weeks, it means that long-term traders earn nothing . While scalpers, as mentioned earlier capitalize on very short movements that happen almost every day, i.e. there is always a chance to earn.

The Dow theory is a financial theory stating the market is in an upward trend if all its averages are in sync.For… Trading too much or getting greedy are two common ways for scalpers to lose money quickly. Request the Ultimate Double Top/Bottom Indicator which is used by 10,000+ traders. Pivot Points – this plots the pivot points of the previous session on the chart. The materials, reviews, and articles are for general information purposes only and do not take into account any personal circumstances or objectives of TradingKit.net website visitors. Nothing of this information is financial, investment, or other advice on which reliance should be placed.